|

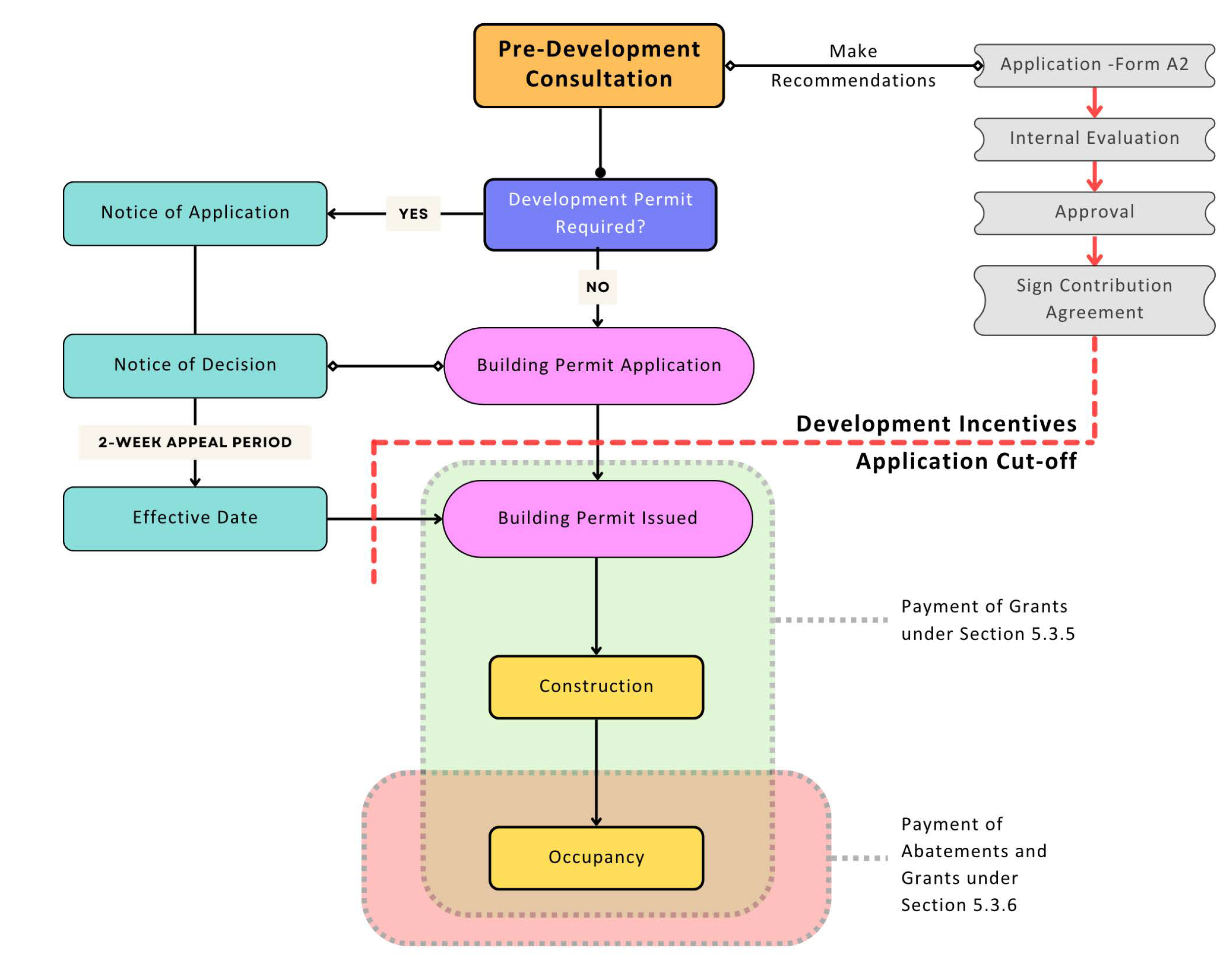

We have tried to respond to frequently asked questions about our development incentives. We will add more information as new questions come up. If you have a question that you would like to see answered on this page, contact our Planning & Environment Division by e-mail at PlanningandEnvironment@yellowknife.ca

Tax Abatements FAQ

| What are Development Incentives? |

| Development Incentives are tools used to direct funds and implement policy towards existing and new development opportunities. Development Incentives can also be in-kind in the form of providing services, amenities or other supportive measures. |

| Who is eligible for the Development Incentive? |

| Applicants must be registered owners of the property and shall not be in tax arrears for any property within the City.

Federal or Territorial owned lands, buildings or projects are ineligible for all programs.

|

|

What are abatements and how are they calculated?

|

|

Abatements are a financial incentive to encourage development and redevelopment initiatives. Once a development is completed it is applied as a tax credit on the property’s tax account.

Abatements only apply to the increase in improvement value and are calculated using finalized assessment values.* Land value is not included in the calculation for an abatement.

*Please note that all abatements must be shown to increase the appraised value of the property by at least $500,000 upon construction completion

|

|

What is the difference between the Five Year Declining Abatement and Full Five Year Abatement?

|

|

The Five Year Declining Abatement provides the applicant the equivalent value of the tax that would be payable for the increase of the improvement value at 100% in year one. The amount of abatement is decreased in equal reduction of 20% over the remaining four years:

(Year 1 – 100%; Year 2 – 80%; Year 3 – 60%; Year 4 – 40%; Year 5 – 20%).

The Full Five Year Abatement provides the applicant the equivalent value of the tax that would be payable for the increase of the improvement value at 100% over five years:

(Year 1 – 100%; Year 2 – 100%; Year 3 – 100%; Year 4 – 100%; Year 5 – 100%).

|

|

Can abatements be applied to all types of developments?

|

|

Abatements are only applied to the following types of developments:

- New residential, commercial or mixed-use developments within the Downtown Zone;

- Adaptive re-use of existing buildings within the Downtown Zone;

- New multi-unit residential and commercial developments; or adaptive re-use of existing buildings with the Residential Central Zone;

- New multi-unit developments within the Residential Central or Residential Intensification Zones; and

- Industrial relocation from sender lands to receiver land*

*Please note that the industrial relocation abatement may be applied to either the sender land or the receiver land, but not both

|

|

After I submit my application, how long will it take until I get the abatement on my tax account?

|

|

Any abated payments will occur upon completion of all of the following:

- a certified property assessment;

- signed contribution agreement; and

- authorization by the Planning Administrator and Director of Corporate Services.

|

| What happens if I am approved for a development incentive but don't complete the project according to the terms and conditions of an Agreement? |

|

Any incentive may be revoked or suspended for outstanding orders or requirements which have not been completed in terms of schedule or for non-compliance. Failure to comply with the terms of the agreement will result in forfeit of all incentives and may require repayment to the City of Yellowknife.

|

Grants FAQ

|

Who is eligible for the Development Incentive Grants?

|

|

Applicants must be registered owners of the property and shall not be in tax arrears for any property within the City.

Federal or Territorial owned lands, buildings or projects are ineligible for all programs.

|

|

Is the City offering any grants and loans as part of the program?

|

|

The City has grants for housing, land purchase, revitalization of existing development and permit fees.

Development Incentives do not include any loans.

|

|

Can I apply for multiple grants at the same time?

|

|

Yes. You may be eligible to apply for multiple grants when a proposed development conforms to each of the regulations under each incentive. Please note that funding is limited.

|

|

Can I apply for both abatements and grants?

|

|

Yes. Abatements and grants may be applied for together and combined to support a development, subject to available funding.

|

|

After I submit my application, how long will it take until I get the grants?

|

|

Payment of the following grants will be made following a successful application, completion of a contribution agreement and based on available funding. Payment may be made prior to construction of the project:

- Universal Commercial Development Grant;

- Secondary Dwelling Grant;

- Affordable Secondary Dwelling Grant;

- Affordable Non-profit Grant;

- Universal Dwelling Units Grant; and/or

- Missing Middle Grant.

Payment of the following grants will be made following a determination by the Planning Administrator that the project has been final completed according to the terms and conditions of the contribution agreement:

- Environmental Impact Study (EIS) Grant;

- Bicycle Racks and Storage Grants;

- Vehicle Share Grant;

- Intensification Servicing Grant;

- Ventilation Systems Grant; and/or

- Development Permit and Building Permit Fee Grant

|

|

What is the Affordable Housing Rate in 2025?

|

|

The Affordable Housing Rate is determined using the CMHC definition of affordable housing and Statistics Canada's income-revenue index. These rates will be updated annually to reflect the latest available data.

Affordable Rental Housing means housing where the total monthly shelter cost (gross monthly rent, inclusive of utilities for heat, hydro, hot water and water) is at or below 30% of the before-tax monthly income of renter households in the City of Yellowknife, as follows:

| Type of Dwelling (Rental) | Income Percentile | Affordable Rent (Rent + Utilities) ≤ 30% of Gross Income |

|---|

|

Studio/Bachelor Unit

|

50th

|

$1,420

|

|

1 Bedroom

|

60th

|

$2,004

|

|

2 Bedrooms

|

60th

|

$2,373

|

|

3+ Bedrooms

|

60th

|

$2,450

|

Affordable Home Ownership means housing where the purchase price (which for new units is inclusive of Government Sales Tax (GST) payable by the purchaser) is at or below an amount where the total monthly shelter cost (mortgage principal and interest – based on a 25-year amortization, 10% down payment and the mortgage rate for a conventional 5-year mortgage as reported by the Bank of Canada in January of the applicable year, and a mortgage insurance premium – plus property taxes calculated on a monthly basis based on the purchase price, and standard condominium fees, if applicable) is affordable, based on paying no more than 30% of before-tax monthly income, to all households in the City of Yellowknife as follows:

| Type of Dwelling (Ownership) | Income Percentile | Affordable Ownership(Mortgage + Property Tax + Condo Fees) ≤ 30% of Gross Income |

|---|

|

Studio/Bachelor Unit

|

30th

|

$920

|

|

1 Bedroom

|

40th

|

$1,240

|

|

2 Bedrooms

|

50th

|

$1,988

|

|

3+ Bedrooms

|

60th

|

$2,450

|

|

|

.jpg)